WORDS TO KNOW

Social Engineering

The use of manipulation by a fraudster to trick people into making mistakes or giving away sensitive information.

Text message scams are on the rise.

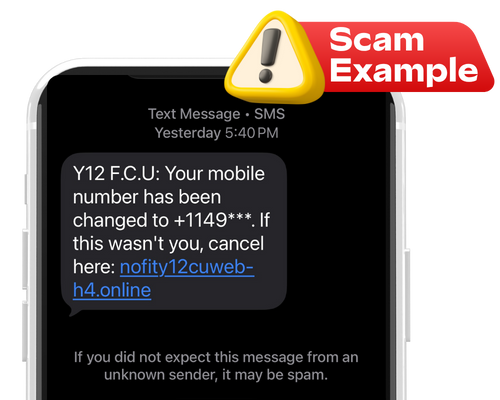

Fraudsters may impersonate your financial institution in text messages, claiming issues with your credit union/bank account or phone number. These messages often include suspicious links designed to steal your information.

ARE YOU BEING SCAMMED?

Ask yourself these questions:

QUESTION 1

Is someone asking for my personal information?

Spoiler- it's probably a fraudster.

Examples include:

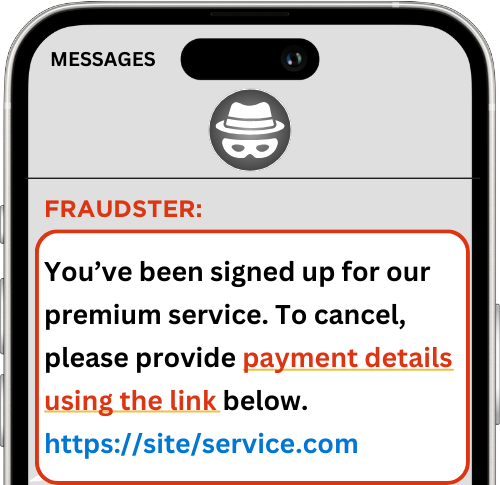

QUESTION 2

Is someone asking me to pay for something unexpected?

Hold your horses! It could be fraud.

Examples include:

HAVE YOU BEEN SCAMMED?

What to do next:

CAN YOU RECOGNIZE A SCAM?

Spot The Red Flags:

PHISHING FRAUD

Emails, Texts, & Calls

PERSONA FRAUD

Online & Social Media

PERSON-TO-PERSON FRAUD

Payment & Marketplace Apps

Popular Scams:

INVESTMENTS

Crypto

This scam tricks someone into sending money or sharing private information by pretending to offer high returns or fake investment opportunities.

ONLINE PAYMENT SITES

QR Code

The fraudster creates a fake QR code that leads to a phishing site. When scanned, the fraudsters can steal personal information through fake payment prompts.

PHONE CALLS/TEXTS

Impersonation

The fraudster spoofs our phone number and pretends to be an employee of the Credit Union to solicit funds or sensitive information.

DATING SITES/APPS

Romance

The fraudster uses a fake persona in the form of a love interest to request money or gift cards using manipulation tactics.

EMAILS/TEXTS

Employment

Employment scams usually present as a remote position or independent contract that promises lucrative pay. The fraudster may ask you for training payments or sensitive information.